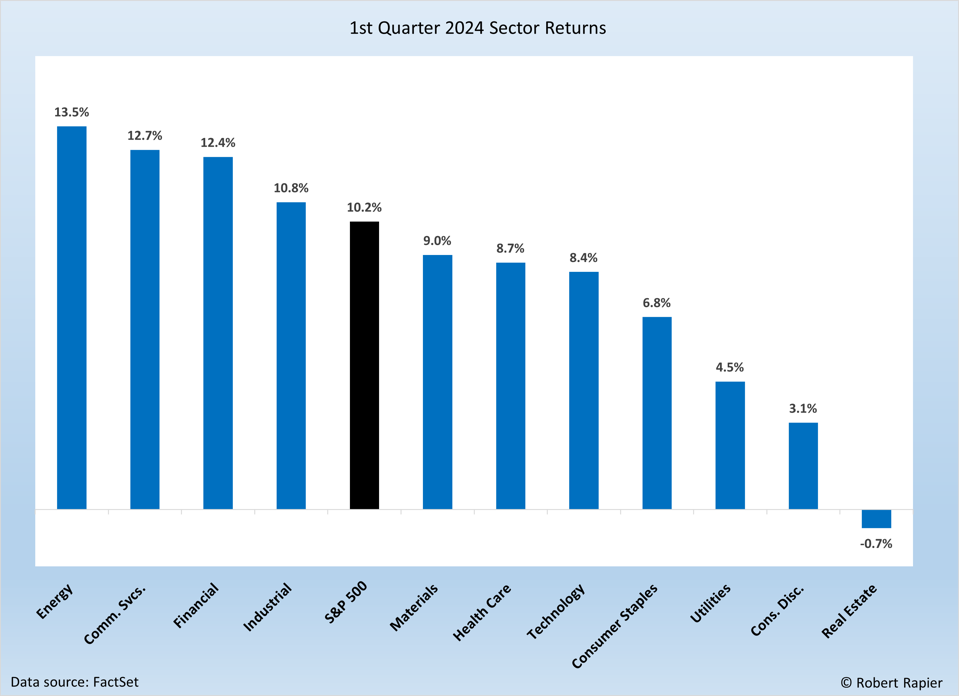

The S&P 500 wrapped up the first quarter of 2024 with a gain of 10.2%, marking its strongest first quarter performance in five years. Additionally, all three major U.S. indices recorded significant quarterly advances.

This climb was fueled by optimism surrounding artificial intelligence (AI) stocks and speculation about potential interest rate cuts by the U.S. Federal Reserve in the coming months.

But the first quarter gains were broad-based, with four sectors notching double-digit gains. The only sector that declined in the first quarter was real estate.

After lagging in 2023, the energy sector returned to the top of all sector returns in Q1 with a 13.5% return. This was driven by rising oil prices during the quarter.

Note that all returns discussed below are total returns, which include the impact of dividend payments.

All segments of the energy sector were up, but the refiners were outstanding for the second straight quarter.

According to data provider FactSet — which I use to analyze companies — the Big Three refiners — Marathon Petroleum, Valero, and Phillips 66 — significantly outperformed the broader energy sector, gaining an average of 30.8%. Marathon led the pack with a Q1 total return of +36.5%, followed by Valero (+32.3%) and then Phillips 66 (+23.6%). That marks two consecutive quarters that these companies returned more than 20%.

The average upstream company — the pure oil and gas producers — gained 10.5% in 2023. Of the 51 public companies FactSet classifies as “upstream”, 40 turned in a positive return. Leading this group was tiny Ring Energy with a return of 34.2%, followed by Diamondback Energy which returned 29.9%.

On the heels of an outstanding Q4 2023, the midstream segment underperformed the broader energy sector in Q1. Among the 40 companies that FactSet classifies as “midstream”, the average return was 9.2%. Summit Midstream Partners LP led the midstream segment with a gain of 56.7%, followed by Targa Resources Corp., which gained 29.7%.

The integrated supermajors were all higher, gaining 7.6%. Among this group, the best performer for the quarter was ExxonMobil, which gained 17.3%. BP was the second-best performer, notching a 7.7% return.

Energy prices are on the rise, without much relief in sight. OPEC+ supply reductions are starting to impact the oil markets, but record U.S. oil production has thus far helped stem the rise in oil prices. Nevertheless, it is hard to envision a scenario in which oil prices significantly drop from here, so the energy sector is likely to do well this year.

Follow Robert Rapier on Twitter, LinkedIn, or Facebook