On May 12, the Energy Information Administration (EIA) released its latest Short Term Energy Outlook (STEO). This report reflects the first deep dive into how the energy demand collapse brought on by the COVID-19 pandemic is impacting energy market projections.

This month’s report includes a special caveat that is indicative of our present unusual circumstances:

“Although all market outlooks are subject to many risks, the May edition of EIA’s Short-Term Energy Outlook remains subject to heightened levels of uncertainty because the effects on energy markets of mitigation efforts related to the 2019 novel coronavirus disease (COVID-19) are still evolving.”

Here are some of the key summarized highlights from the EIA report, followed by my commentary on these projections. Some of the projections are far more optimistic than I would have expected.

Global liquid fuels

- Brent crude oil prices will average $34/b in 2020, down from an average of $64/b in 2019. EIA expects prices will average $23/b during the second quarter of 2020 before increasing to $32/b during the second half of the year. Brent prices are expected to rise to an average of $48/b in 2021, as declining global oil inventories next year will put upward pressure on oil prices.

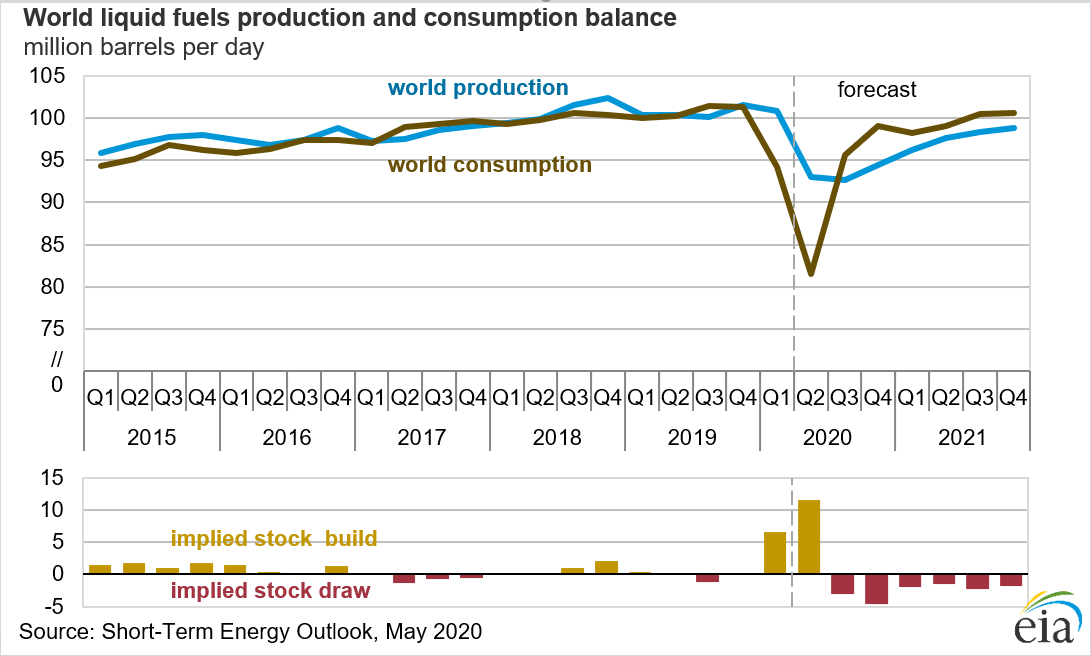

- Global petroleum and liquid fuels demand will average 92.6 million b/d in 2020, a decrease of 8.1 million b/d from last year, before increasing by 7.0 million b/d in 2021.

- Global liquid fuels inventories will grow by an average of 2.6 million b/d in 2020 after falling by 0.2 million b/d in 2019. EIA expects inventory builds will be largest in the first half of 2020, rising at a rate of 6.6 million b/d in the first quarter and increasing to builds of 11.5 million b/d in the second quarter as a result of widespread travel limitations and sharp reductions in economic activity.

- EIA forecasts significant decreases in U.S. liquid fuels demand during the first half of 2020 as a result of COVID-19 travel restrictions and disruptions to business and economic activity. The largest impacts will occur in the second quarter of 2020 before gradually dissipating over the next 18 months.

- U.S. crude oil production will average 11.7 million b/d in 2020, down 0.5 million b/d from 2019. In 2021, EIA expects U.S. crude oil production to decline further by 0.8 million b/d.

Natural gas

- Natural gas prices will generally rise through the rest of 2020 as U.S. production declines. EIA forecasts that Henry Hub natural gas spot prices will average $2.14/MMBtu in 2020 and then increase in 2021, reaching an annual average of $2.89/MMBtu.

- Total consumption of natural gas to average 81.7 billion cubic feet per day (Bcf/d) in 2020, down 3.9% from the 2019 average primarily because of lower industrial sector consumption of natural gas. Industrial natural gas consumption is expected to average 21.3 Bcf/d in 2020, down 7.1% from 2019 as a result of lower expected manufacturing activity.

- U.S. dry natural gas production set a record in 2019, averaging 92.2 Bcf/d. Dry natural gas production is projected to average 89.8 Bcf/d in 2020, with monthly production falling from an estimated 93.1 Bcf/d in April to 85.4 Bcf/d in December.

- U.S. liquefied natural gas exports will average 5.8 Bcf/d in the second quarter of 2020 and 4.8 Bcf/d in the third quarter of 2020. U.S. liquefied natural gas exports are expected to decline through the end of the summer as a result of lower expected global demand for natural gas.

Electricity, coal, renewables, and emissions

- The effects of social distancing guidelines are likely to continue affecting U.S. electricity consumption during the next few months. EIA expects retail sales of electricity in the commercial sector will fall by 6.5% in 2020 because many businesses have closed and many people are working from home. Similarly, industrial retail sales of electricity are projected to fall by 6.5% in 2020 as many factories cut back production.

- Total U.S. electric power sector generation is projected to decline by 5% in 2020. Most of the expected decline in electricity supply is reflected in lower fossil fuel generation, especially at coal-fired power plants.

- After decreasing by 2.8% in 2019, EIA forecasts that U.S. energy-related carbon dioxide (CO2) emissions will decrease by 11% in 2020. This record decline is the result of restrictions on business and travel activity and slowing economic growth related to COVID-19.

Commentary

The EIA is projecting a significant recovery of energy prices in the second half of this year, and then a major recovery in demand next year.

Because of the sudden and dramatic impact on the global energy sector, this STEO reflects enormous changes from recent reports. The world’s energy system is complex and interlinked, and the impacts one sector may have on another aren’t always immediately obvious.

For example, the collapse in global oil demand has an obvious impact on global oil prices. In fact, the May STEO contains a graphic that clearly illustrates why oil prices collapsed in the first quarter of this year.

The world has simply never seen such a dramatic decline in demand for liquid fuels, which in turn led to a large increase in inventories for petroleum and finished products. That put downward pressure on prices, but also greatly increased the premiums received by companies that can store oil (both in onshore tanks and in ships).

In addition, the U.S. produces a lot of natural gas as a byproduct of oil production. Because oil production is falling in response to the demand collapse, that natural gas byproduct is also falling in places like the Permian Basin. That decline in natural gas production prevented natural gas prices from experiencing the collapse seen in the oil markets. As a result, even though natural gas demand is down too, companies that are predominantly natural gas producers have been among the best performers in the energy sector since the oil price collapse started.

The disruptions to U.S. businesses have cut into electricity demand, which is disproportionately impacting coal generation. Because there was significant momentum in the growth of renewables for new generating capacity, the EIA is forecasting that renewables will outpace electricity production for coal in 2020 for the first time. The trend had been clear for years that renewables would overtake coal, but the COVID-19 impact has accelerated the timeline. As a result, it seems likely that renewables have now permanently overtaken coal in the U.S. power sector.

One of the few long-term silver linings from this pandemic will be the positive impacts on the environment. The decline in demand for fossil fuels across the board leads to a prediction of a record decline in U.S. carbon dioxide emissions.

As fossil fuel demand plunged in response to the pandemic, the skies and waterways in many locations cleared. I believe those images will be a powerful long-term reminder of the environmental impact of limiting our fossil fuel consumption.

Follow Robert Rapier on Twitter, LinkedIn, or Facebook.