The U.S., that is, in total fossil fuel resources. At least those were the findings of the Congressional Research Service in a report they just released:

U.S. Fossil Fuel Resources: Terminology, Reporting, and Summary

The primary reason is our huge coal reserves. While we are 12th in oil reserves (Table 5 of the report), our coal reserves are by far the largest in the world. All together, the fossil fuel reserves (oil, natural gas, and coal) of the U.S. are reported at just under one trillion barrels of oil equivalent (BOE). The global total is reported at 5.6 trillion BOE.

While I think you have to take data from some of the listed countries with a grain of salt – especially when talking about categories like “undiscovered technically recoverable” oil and natural gas – it does point to the importance that coal will play when oil reserves start to seriously deplete. I have said this before, but when gasoline is $5/gallon, most objections to coal as a fuel will disappear. At that point I think you will start to see coal-to-liquids (CTL) plants moving forward.

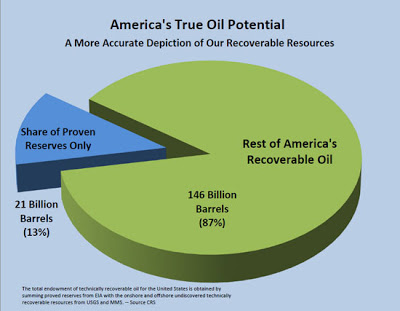

Also from the report, at first glance this chart may seem ridiculous:

But I am also reminded of my amazement at a U.S. oil statistic I once came across. In 1982, U.S. reserves were 27.9 billion barrels. In 2005, U.S. reserves were 21.8 billion barrels. But over the course of that 24-year period we produced 57 billion barrels of oil and pulled our reserves down by only 6 billion barrels. So the graph above seems far-fetched, but so does the evolution of our reserves over past quarter century.

Of course it goes without saying that government policies will heavily influence which resources are developed, and over what time period. My guess is that over the next few years we will favor policies that are intended to wean us off of fossil fuels. While I applaud good intentions – and in fact my new job is all about moving developing fossil fuel replacements – I expect we are going to see more than a few unintended consequences. The one I am most concerned about is heavily disincentivizing domestic production, but not having an adequate answer for the domestic production shortfall. In this case, while more alternative energy may be the target, more oil imports may be the unintended consequence.

heavily disincentivizing domestic production

Like Obama's claim "I will work with my colleagues at the G20 to phase out fossil fuel subsidies so that we can better address our climate challenge"?

I wonder if that's just political words, not to be followed by any real action.

http://www.pri.org/science/environment/fossil-fuel-subsidies-climate-change1640.html

Like Obama's claim "I will work with my colleagues at the G20 to phase out fossil fuel subsidies so that we can better address our climate challenge"?

I don't think we should be subsidizing fossil fuels. On the other hand, I also don't think we should put our domestic fossil fuel industry at a disadvantage to foreign competitors.

RR

I charted US proved reserves and production, they simply tracked each other, with a sharp spike for the discovery of Prudhoe that would've misled anyone attempting to predict peak around that time. This suggests to me that an early assessment of a region, after sufficient time for exploration and technical development, will give an URR that can be used to calculate when peak occurs, given fairly constant exploitation. The post peak reserves growth is of note only for determining the steepness of the tail.

Do stripper well operators report their reserves? Seems a bit of an imposition on such a marginally economic business. Perhaps this is part of why the US has produced so much more than its reserves, which won't be replicated in other nations which are dominated by NOCs and have no potential for independent operators.

Publicly held operators will report reserves from stripper well assets just like from any other producing asset. A reserves auditor will look at decline curves and allocate remaining reserves. To the extent that many of these are privately held concerns, however, there may be a slight negative reserves bias. But since US producers ranked #500 through #13,800 or so account only about 10% of domestic production, I'd think this factor is probably not critical. More important I suspect is the big new Gulf of Mexico discoveries, new reserves grown by EOR schemes, and reserves created by higher prices.

Also, I think it's something of a misconception to assume that stripper well operators are a class of their own. Chevron, for example, produced 69.6 mmbo from 16,300 wells in California in 2007. This means Chevron's average California well produced about 12 bopd that year.

I wonder if that big slice of pie in the graphic assumes any government incentives (the S word), such as deep water or shale oil reserves.

God certainly blessed the US with resources. North America also has 70% of the world's fresh water.

I knew we had lots of coal,but hadn't seen the reserves expressed in BOE form. 900 billion barrels is amazing. Triple Saudi oil reserves. Natural Gas is a bit less impressive when converted to BOE.

The oil pyramid sure put things in perspective. If that 800 billion barrels at the bottom becomes recoverable we'll have 30% of the world's fossil fuel. Chevron claims their in-situ shale process will produce more water then it uses. They also claim they'll be sequestering lots of CO2. Wouldn't it be wild if shale oil turned out to be a net positive for the environment?

Always be very cautious when seeing reports on "reserves". The word is often misused. It can mean anything from the fairly certain volume of "Proved Developed Producing" to a wild-assed guess at the volume of undiscovered oil in place.

Also, be cautious about the word "subsidy". When the Political Class takes a big slice of your income by threat of force (taxes) and then gives you back a little bit of your own money as a tax break on mortgage interest, is that a "subsidy"?

Fossil fuels are net tax payers. In constrast, bird whackers and ethanol are net tax recipients. It is not sustainable for an energy source to be subsidized.

"and then gives you back a little bit of your own money as a tax break on mortgage interest, is that a "subsidy"?"

It might feel that way to a taxpayer who rents.

"Fossil fuels are net tax payers"

Let's not count the trillion dollar cost of Iraq. Or the cost of keeping two carrier battle groups in the Persian Gulf.

“In constrast, bird whackers and ethanol are net tax recipients.”

Are you sure? I think it too early to tell what the benefit is and it may be just a little more complected than you think.

The 104 nuke plants in the US are a good example. They are all now cash machines for tax revenue. Every time a new nuke came on line, an oil burning plant went off line. This helped reduce the price of oil and making electricity cheaper.

So you have to ask yourself what the price of fossil fuels would be without the contribution of non-fossil sources.

More than 10 years ago I was asked about the economics of partnering in a wind farm. Based on my company's prediction of natural gas prices, the wind farm would never be economical. By the time the wind farm came on line, generating cost for wind were half of NG.

So tell me what NG, and O&M cost will be in 20 years. Since it rare to find a sure fire 20 prediction that is not wrong in 5 years, I would suggest that you can not be even close to sure.

What PTC do is drive down the cost of NG home heating which benefits all taxpayers indirectly.

“two carrier battle groups in the Persian Gulf”

Which are training our young people things like nuke plant operation, jet engine maintenance, fire fighting, and first aid.

So Maury, if I am an example, not only did I stand the line for 30 years ago but I am also subsidizing your urban lifestyle now with the higher taxes I pay.

Sure the US has become the world's policeman with the help of other counties. I thing is it great that the US has 10 super carriers. Japan and Germany have none. What is cheaper protecting friends or battling past foes that rearm?

Thanks for your reply, armchair261. Wasn't sure how that was done, I couldn't see the gov doing a seismic shoot for every dinky puddle of brine stained gunk out there. Now, are they estimating URR using something akin to HL? Or a more complicated method? I know the majors have a lot of low volume producers, but the phenomenon of Ma and Pa earning a buck off their 1 bo/week is a uniquely American phenomenon. Are NOCs around the worldwide also tending low output wells like that, though? Certainly not in the case of offshore, but how about in OPEC? Or is this yet another facet of world oil production that remains shrouded in complete mystery?

And – sorry about this avalanche of questions – would NOCs do well to farm out stripper wells to the man in the street like the US has, or is this just eternally politically unfeasible? Also I've been told that the majors and independents have a bar set for how low their new production will be – it's uneconomical for them to muck about with the small fry. But, as you say, that certainly doesn't apply to heritage assets, Kern River for one, a very overdrilled and venerable field that has been punched up like a pincushion.

You missed the point Kit. We pay a lot more for gas than what it costs at the pump. Most people aren't aware of the mutual defense pact we've got with Saudi Arabia,for example. We're obligated to defend the royal family from all threats,internal and external. Never mind that the Saudi embassy in D.C. passes out brochures calling for jihad against the Great Satan. We needs our oil.

Fossil fuels have direct and indirect costs. Imported oil is half the trade deficit. It's trashing the dollar. We all pay more as a result. For almost everything.

Robert said in one of his recent posts that energy independence would cost taxpayers $200 billion per year in subsidies. That's just a fraction of what oil is costing us imo.

I expect we are going to see more than a few unintended consequences. The one I am most concerned about is heavily disincentivizing domestic production, but not having an adequate answer for the domestic production shortfall. In this case, while more alternative energy may be the target, more oil imports may be the unintended consequence.

I wouldn't lose sleep over it, RR. $5/gal creates its own insensive, quite independent of the prostitutians. The Beauty of Capitalism?

"trillion dollar cost of war in Iraq" Maury seems squarely in the "no blood for oil" camp. I would point you to the following paper: The Energy Security Obsession

America was a superpower in the 1950s and 60s when Texas was the oil capital of the world. The US spends a lot of money protecting Japan and South Korea, no oil there. Or Western Europe, not much oil there.

Robert: I wrote a study for IEA Coal Research (the coal-research arm of the International Energy Agency) back in the mid-1980s and scrutinized the various coal "reserve" numbers around the world. They do not actually describe reserves as you know them in the hydrocarbon world, but estimates of the "reserve base" — the amount that, with a high degree of probability (determined by the density of outcrop observations and core samples) is believed to still be in the ground within certain boundaries relating to seam thickness, seam depth and overburden ratio.

These cut-off criteria vary enormously by country, however. Based on some reasonable assumptions, for example, if one applied to the United States the more conservative criteria used by Australia, that U.S. coal "reserves" would be much smaller. Some countries' coal "reserves" subtract out deposits that cannot be mined because of water, proximity to roads and structures, inclination, etc. Start accounting for these no-go areas, and the numbers shrink some more.

So, in short, the coal "reserve" numbers have always been exaggerated compared with what could likely be mined economically — even ignorring the likelihood that because of climate policies, much of it will never be extracted.

— Ron Steenblik

The reason that US reserve quotations are always minuscule compared to actual recoverable reserves is due to very strict SEC rules on what can be claimed as "proved", as proved reserves are a balance sheet item and there are always fears companies will over-report to boost share price. The net result is that reserves are structurally under-reported in the US. It happens for gas as well as oil. The US has had '10 years' of proved gas reserves at existing R:P ratios for as long as I can remember.

In answer to Clee, who asks whether Obama's commtment at the G-20 summit "to work with … colleagues to phase out fossil fuel subsidies" is just political words, not to be followed by any real action:

It is more than just words. The OECD, IEA and World Bank are already gearing up to do some major work in this area. (I know this because I am part of this team). Implementation will obviously depend on the will of the institutions — in the case of the United States that means the Congress — to enact the necessary laws. But I can assure you that the U.S. Administration (and those of several other G-20 countries) are serious.

— Ron Steenblik

"Maury seems squarely in the "no blood for oil" camp."

I was all for removing Sadman Insane. But,those weren't Iraqi's that flew into the World Trade Center on 9/11. They were Saudi's. And the Saudi's are producing a hundred terrorists for every one we kill today. They're brainwashed to hate America from the time they enter kindergarden. Meanwhile,we defend them from all enemies,foreign or domestic. It's not just insane. It's suicidal.

I agree with the sentiments of many here that projections of reserves seem problematic. Sometimes, we getting better at extraction, and suddenly reserves boom–witness oil sands in Canada, or shale gas in the USA. The good news is that if anything, reserves seem to grow–witness RR's post.

But to quote the great Kinu, "politics trumps geology."

There are huge gobs of oil in the world, but the Oil Gods favor thugs, and so the oil is on thug states.

BTW, China announced yesterday a deal with BP and Iraq to triple–triple–output from one of Iraq's major fields, the 3 mbd per day.

3 mbd a day from one field in Iraq.

I guess Peak Oil gets pushed back again..and again…again..one more time, and again I see on TOD they are talking doom in five years out—is it ever five years out?

Maury said: God certainly blessed the US with resources. North America also has 70% of the world's fresh water.

I'm always cautious about stats like that. 70% of the worlds fresh water is in the Greenland and Antarctic ice caps. I guess you mean 70% of the other 30%. And yet wikipedia tells me that the Amazon "is responsible for about 20% of the total volume of fresh water entering the oceans worldwide". And the self-same wikipedia says that Lake Baikal "contains a total of roughly 20 percent of the world's surface fresh water".

So even if there was no other fresh water anywhere on the planet (and there is), the US's fresh water would have to be in non-surface reservoirs for that stat to be reconcilable. And then there's things like that aquifer with the unpronounceable name under your mid-west that it's claimed is not a sustainable source of water because it's not being replenished.

Perhaps that's why it's claimed that less than 1% of the world's fresh water is sustainably usable, i.e. that water which is constantly replenished as part of the hydrologic cycle.

Meanwhile, oil demand falling..and falling…and falling….

The International Energy Agency next week will make a "substantial" downward revision to its long-term forecast for global oil demand, a person familiar with the matter said, marking the second year running the group has slashed its view of the world's thirst for oil.

The forecast of slower growth in oil demand puts the IEA increasingly in a camp of contrarians bucking the popular view that crude demand will grow briskly in a postrecession world. That view holds that long-term demand will grow at a fast clip because of rising emerging-market wealth and consumption in places like China and India.

The ol' price mechanism at work. Higher prices=lower demand.

I have to say, the OPEC business model–threaten customers with high and erratic prices, and threaten cutoffs of supply–is not one I have seen taught at business schools.

Unless OPEC figures out a way to keep oil cheap and plentiful, the world will pass them by…we already are.

I keep reading about lithium batteries with two– or three-fold improvements from current generation.

We are close, so close, to closing out the ICE era, if we need to. The nuke-PHEV model makes sense to me. I suspect in 10 years that is where France and Japan will be.

KLR,

Not sure what you mean by HL.

One thing to be careful of is the terms "reserves." It's properly used formally as an accounting measure (as mentioned by Richard Hands) to represent oil that can be recovered with very high confidence. But often, especially in the press, the term "reserves" is downgraded to include a grab bag of proven plus any possible oil accumulations, for example MMS estimates of offshore oil volumes. The latter is better termed "resources."

Reserves are often estimated by decline curve analysis from existing wells. For a producing field, URR is typically a combination of produced oil plus reserves based on decline analysis.

URR for resources, as opposed to reserves, is typically estimated volumetrically with assumptions on reservoir properties and bulk rock volume. The volume can be estimated from seismic data or regional study. Both reserve and resource estimates will have some kind of price assumption built in, although the term "technically recoverable" eliminates the price uncertainty. I'm not sure what the assumptions are in the featured report as far as what's recoverable.

Anywhere where oil is produced, NOC's or Oklahoma, wells will generally stay online until it costs more to maintain them to produce them. This is the concept of the well economic limit. Probably the main difference between an NOC and a small operator is the incentive. Ma and Pa are highly motivated to keep their well flowing, and motivated to shut it in as soon as they start losing money on it. Such wells though may not get the same attention at large companies, so there can be some neglect. I'd guess in the case of NOC's that these volumes are small relative to total production. You'd need an awful lot of stripper wells in Saudi Arabia to make even a small fraction of Ghawar's day rate.

NOC's have tried to fob off poorer assets on foreigners and sometimes get takers. Venezuela, Russia, and Egypt are examples of this that I am personally aware of. But many of these countries just don't allow much foreign investment, or the political risk is seen to be too high, or often the assets are commercially unattractive relative to other competing investments. Typically a major won't be too interested, as they will often have profit or materiality thresholds that these kinds of projects can't survive. Very small operators usually don't want to make this kind of gamble – starting from square one in a new country (let alone state) is not so easy since a lot of the skills are not easily transferable. Operating in say Egypt versus Oklahoma can be hugely different in terms of geology, regulations, procurement, accounting, etc. This is typically the domain of the independent.

Majors are mostly worried about replacing production. For an Exxon to add a billion barrels per year, it just doesn't make much sense for them to allocate scarce staff and resources to small fry projects – which are often manpower intensive (lots of wells to understand and maintain). But if they already have a project like this, such as Chevron's Kern River, then they have the staff and expertise in place and will probably keep it going as long as it's profitable. Alternatively, you often see a major selling out of a field that is getting to this advanced stage in its life cycle. It's hard to book reserves in a very mature field, and a major has to be asking itself whether cash flow from hundreds or even thousands of small wells in a mature field fits into their future.

"It is more than just words. The OECD, IEA and World Bank are already gearing up to do some major work in this area."

Wow! I feel better already. The "problem" will be solved by a bunch of over-priced bureaucrats and lawyers with a track record of failure and no understanding of the Laws of Physics.

The "problem" is not lack of resources. The "problem" is not lack of technology. The "problem" is the Political Class.

Yeah,stats are funny like that Pete. There's enough water in the Great Lakes to cover the continental US with 9.5 ft. of it. 600,000 cu. ft. of water flow past my house and into the Gulf of Mexico every second. There are roughly 7500 gallons in a cubic foot. We're definately blessed with more freshwater than we'll use anytime soon. It could be more evenly distributed though.

"There are roughly 7500 gallons in a cubic foot."

I took the liberty of rounding that up from 7.489….LOL.

The IEA language requires translating.

IEA speak: Demand = Supply.

If supply is falling, "demand" is falling.

OECD "Demand" is down about 4.5 mbpd. Japan, and Europe really can't get much more efficient. The US can, maybe, increase efficiency by 1%/yr.

Conclusion: For the OECD "consumer" to come out of recession they will have to start importing about 4.5 Million bpd more oil.

China, India, and OPEC will use another 1 mbpd next year, regardless of What WE might do.

We Need another 5.5 Million bpd of oil next year. Or, we stay in Recession.

A lot depends on what you call a "subsidy". Some subsidies are worse than others. At times state run companies in China buy oil and coal on the world market and then imports and sells it at a loss. Oil exporting countries often sell gasoline at below market or production prices.

In the US sometimes people claim reduced royalties or tax incentives are a "subsidy" for oil and gas. But since the US taxes corporations at one of the highest rates in the world – such policies aren't really subsidies.

Yeah, I know, technically we "grew" at 3.5% last quarter; but that was actually just a little "inventory rebuild," and some other "technical" factors. The Consumer (Us) is still moribund. Unemployment is going up, again, in the Friday Jobs Report.

There's really no way we can get back to where we were a year ago without using the oil we were using a year ago.

And, China Is NOT going to quit growing.

Well, good, KoK. That means ethanol isn't subsidized.

Maury:

"There are roughly 7500 gallons in a cubic foot."

I took the liberty of rounding that up from 7.489….LOL.

Aw. You spoiled my opportunity to tell you that by your reckoning my fridge should hold 720,000 cans of beer.

🙂

Maury:

"We're definately blessed with more freshwater than we'll use anytime soon. It could be more evenly distributed though."

That's the problem, isn't it. You're not going to start piping water from the Great Lakes across the Rockies to supplement the Colorado anytime soon presumably.

It'd probably be as easy to tanker it over from Ireland, and God know we've got more than our fair share — it's not the "Emerald Isle" by accident. Come to think of it, we haven't a drop of liquid fuel of our own — maybe we could do a swap.

Benny:

"Meanwhile, oil demand falling..and falling…and falling….

… The ol' price mechanism at work. Higher prices=lower demand."

… except that's not what seems to be happening right now. I've been looking at the price of crude every day for the last two months in comparison to the stock markets and without fail, if the markets are up crude is up, and vice versa. I can't believe that has anything to do with real demand whatsoever.

(Although I don't want to get embroiled in any of the religious arguments I've seen about whether speculators are manipulating crude prices. But speaking of which: this was interesting).

Robert,

Just watched a program last night saying that Native American lands encompassed about 1/3 of our fossil resources (mostly coal)

No wondwr Robert is out trying to smoke the peace pipe with native Americans.

Vwry good Robert.

John

PeteS-

The damage from the 2004-2008 price spike has been done. Demand wavered, and started heading south even before the global crumple.

Oil demand responds to the price signal, but in delayed and accretive fashion.

This usually results in honking gluts. That is, the higher prices are sticky enough to encourage production, whule users start to crank back, permanently. The guy with a smaller car does not go out and buy a bigger car rigth away, even if prices go down.So, new production comes on stream, just as demand withers. Glut.

That happened again in 2009, and OPEC had to take 4 mbd off world markets. Now, we have China targeting fresh production of 2 mbd in Iraq.

I agree that prices are set on the NYMEX in mysterious fashion. I will only say that if a system can be gamed, then it will be gamed, and there are certainly sellers with huge financial resources who would game the NYMEX system.

Maury-

Yeah, stats. There was the time me and three economists tried to walk across Lake Woebegone, as we had determined the average depth was only 4 feet.

RR

Coal to liquids…….. I get it..

Let's smoke the "peace pipe" with the native Americans, SO WE CAN MAKE FUEL for the ICE from coal.

Coal to Liquids………one of Roberts' big "hydrocarbon dreams"

John

Let's smoke the "peace pipe" with the native Americans, SO WE CAN MAKE FUEL for the ICE from coal.

Sorry, John, but you don't get it at all. I will take your word for it, but I wasn't even aware that there was a lot of coal under native lands. That's not my interest anyway. My interest is wood.

RR

Although I don't want to get embroiled in any of the religious arguments I've seen about whether speculators are manipulating crude prices. But speaking of which: this was interesting

Pete did you mean interesting or disturbing?

From the linked page [with comments]: So if paper traders push up the Argus price too fast[Is there a speed limit for these things? How do we know its paper traders as opposed to conventional demand?], an extra couple of tankers of Saudi crude headed towards Texas should quickly persuade them to step back [Are speculators affraid of shipments, but not anything else (SEC, regulators, agry prostitutians, presidents, etc.)?]. Indeed, with a huge 4 million bpd of output capacity on hand, Aramco would probably only need to hint at extra shipments to get the desired result [Woohoo! Desired result, eh? Desired by who?].

So let's assume that the argument put forth in the linked article made sense (one could take it apart paragraph by paragraph, if one had the time and inclination).

Are we supposed to be comforted by the idea that we move the market manipulation from the hands of speculators to our allies in Saudi Arabia? Are we supposed to believe that Saudi Aramco would never ever manipulate the markets in ways that may hurt its allies and favorite customers?

No thanks. I'd rather take my chances with speculators on the NYMEX…

Robert,

I'll take your word for it.

As much as 1/3 to 1/2 of our existing fossil reserves are within the boundaries of existing tribal control.

This is problematic for persons wanting to exploit these resources.

We will, of course take the last of these resources from our native American friends.

"This is the way way of the "white man:"

What he cannot steal at the point of a gun, he will steal with a lawyer's pen.

John

We will, of course take the last of these resources from our native American friends.

I might also point out, John, that as is the case with many people from Oklahoma, I am descended from Cherokees on both sides of my family. It is a minority of my bloodline, but there nonetheless.

RR

Benny Cole wrote: Meanwhile, oil demand falling..and falling…and falling….

That may be, but it is certainly not supported by your following statement.

The International Energy Agency next week will make a "substantial" downward revision to its long-term forecast for global oil demand, …

The forecast of slower growth in oil demand puts the IEA increasingly in a camp of contrarians bucking the popular view that crude demand will grow briskly in a postrecession world.

So the IEA forecasts slow growth in demand and just about everyone else forecasts brisk growth. But they all forecast growth in demand. None are forecasting falling oil demand.

Optimist said: "Are we supposed to believe that Saudi Aramco would never ever manipulate the markets in ways that may hurt its allies and favorite customers?"

Lesser of two evils perhaps. Do you want Saudi manipulation or NYMEX speculation ON TOP OF Saudi manipulation?

"We will, of course take the last of these resources from our native American friends."

I was on a flight once with a native American who made his fortune selling water rights. Trust me,native Americans would love to have their oil,natural gas, and coal exploited.

Robert –

This is completely off topic, but I just noticed you have linked Two Cents Per Mile on your blog. Is this a book worth picking up? Thanks.

-Melanie

Wow! I feel better already. The "problem" will be solved by a bunch of over-priced bureaucrats and lawyers with a track record of failure and no understanding of the Laws of Physics.

Ain't he (Kinauchdrach) sweet! With obviously no knowledge of the people or the process involved, he simply resorts to insults.

Failed track record? The only reason that there are disciplines on subsidies to agriculture in the WTO is because somebody (a team of subsidy experts at the OECD in the 1980s) did the spade work first, and produced a time series of standardized, comparable numbers. Those subsidy estimates are still the ones of record. Total subsidies have not been reduced as much as we all might have hoped, but the share of the most-distorting subsidies has been reduced thanks to the transparency and analyses done by OECD analysts and other researchers working with the data.

Many of the analysts working on energy at the IEA and the World Bank have substantial training in requisite subjects (petroleum engineering, economics and … yes, even physics) and experience in the industry. Any "failures" you may have in mind concerning the World Bank probably relate to the funding of specific projects. Those decisions are made by a different group of people.

So, if you think there is no value in a group of people starting to try to put together estimates of subsidies across countries using a common set of definitions and methods, what is your alternative?

— Ron Steenblik

This is completely off topic, but I just noticed you have linked Two Cents Per Mile on your blog. Is this a book worth picking up? Thanks.

Hi Melanie,

I have not read the book; I have just had some e-mail correspondence with the author. Probably OK from what I have seen, but can't say with 100% certainty.

Cheers, Robert

Well, good, KoK. That means ethanol isn't subsidized

Nope, not even close. Ethanol is subsidized, because only certain kinds of ethanol, made a certain way, get exempted from a tax that applies to all fuels made domestically or imported.

The other part of my test would be whether or not the product would be produced were if it NOT for the subsidy. Clearly in the US nobody would make ethanol from corn to blend into motor fuel but for the blend credit.

The direct subsidy of gasoline in Venezuela or coal in China is more egregious because the low prices encourage consumption.

Ron Steenblik wrote: "Any "failures" you may have in mind concerning the World Bank probably relate to the funding of specific projects."

What does a bank do if not fund specific projects?

But if your main point is that bureaucrats can quantify "subsidies", then maybe they should start with quantifying how much money has been taken by threat of force from ordinary people to subsidize incompetence & corruption.

Face it — the world would be a better place if the World Bank and its ilk were zapped right now.

What does a bank do if not fund specific projects?

There is a lot of work that the Bank does that is of an advisory and analytical nature. The experts in these sections of the bank are among the top in the world.

But if your main point is that bureaucrats can quantify "subsidies", then maybe they should start with quantifying how much money has been taken by threat of force from ordinary people to subsidize incompetence & corruption.

Good idea. But why restrict it to the international level? There is plenty of taxpayer-subsidized incompetence and corruption at the local level … in all countries.