In 2003, the late author and investment banker Matther Simmons predicted that with “certainty,” by 2005 the U.S. would enter a long-term natural gas crisis for which the only solution was “to pray.” T. Boone Pickens and a number of high-profile energy insiders concurred.

ConocoPhillips and ExxonMobil made large acquisitions of natural gas companies, betting on a future with much higher natural gas prices. Liquefied natural gas (LNG) import terminals were being built to help address the expected supply shortfall.

By 2005, U.S. natural gas production had begun to decline. Natural gas spot prices regularly spiked above $10 per million British thermal units (MMBtu), and sometimes as high as $15/MMBtu.

What happened next was unanticipated. Natural gas producers were experimenting with a combination of hydraulic fracturing (“fracking”) and horizontal drilling. Their success would change everything.

Instead of an ongoing decline, by 2007 U.S. natural gas production was moving substantially higher. The industry was in the early stages of the largest expansion of U.S. natural gas production in its history.

A decade later, natural gas production was 50% higher than the level in 2007. Today, it is 86% higher and still climbing. Along the way, LNG import terminals were converted into LNG export terminals, and many more were built.

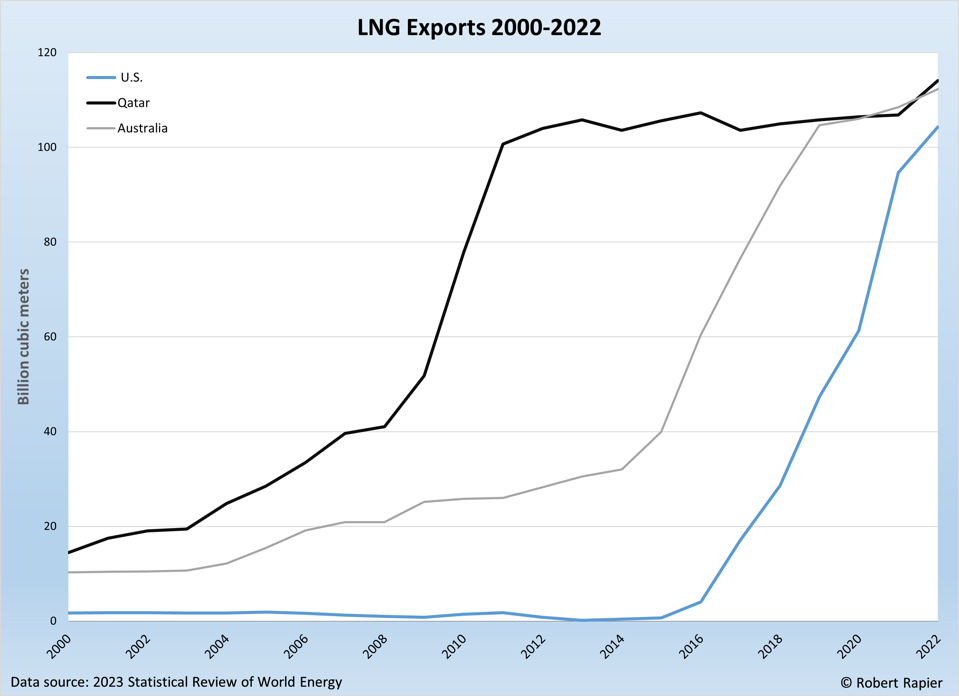

Natural gas expansion was so dramatic, that in 2016, the U.S. began to sharply increase LNG exports. At first, exports were a drop in the bucket compared to those of Qatar and Australia — the world’s two largest LNG exporters. But the rise was steep, and by 2022 it looked like a possibility that the U.S. could soon overtake those countries as the world’s largest LNG exporter.

That has now happened, according to data compiled by Bloomberg. Data through the end of December 2023 showed record U.S. exports of 91.2 million metric tons. The U.S. became the world’s leading LNG exporter in 2023, surpassing Qatar and Australia.

The increase in production was attributed to the return of Freeport LNG to full service, adding 6 million metric tons, and the full-year output of Venture Global LNG’s Calcasieu Pass facility, which added 3 million metric tons more than in 2022.

This is an extraordinary achievement for U.S. natural gas producers, but it is even more impressive when you consider the state of the industry in 2005. It turns out that predicting the future is hard, even for an integrated supermajor like ExxonMobil.

Follow Robert Rapier on Twitter, LinkedIn, or Facebook