Following my recent article detailing Average Gasoline Prices Under The Past Four Presidents, I received a flurry of feedback. Some commentors were angry about a comment I made in that article that Russia’s invasion of Ukraine helped boost gasoline prices last year to record levels.

If I can summarize the gist of the comments, it would be: “You don’t know what you are talking about. This is all Biden’s policies. It had nothing to do with Russia or Ukraine.” One person insisted that I don’t understand the oil industry or oil refining, despite having spent years actually working in a refinery.

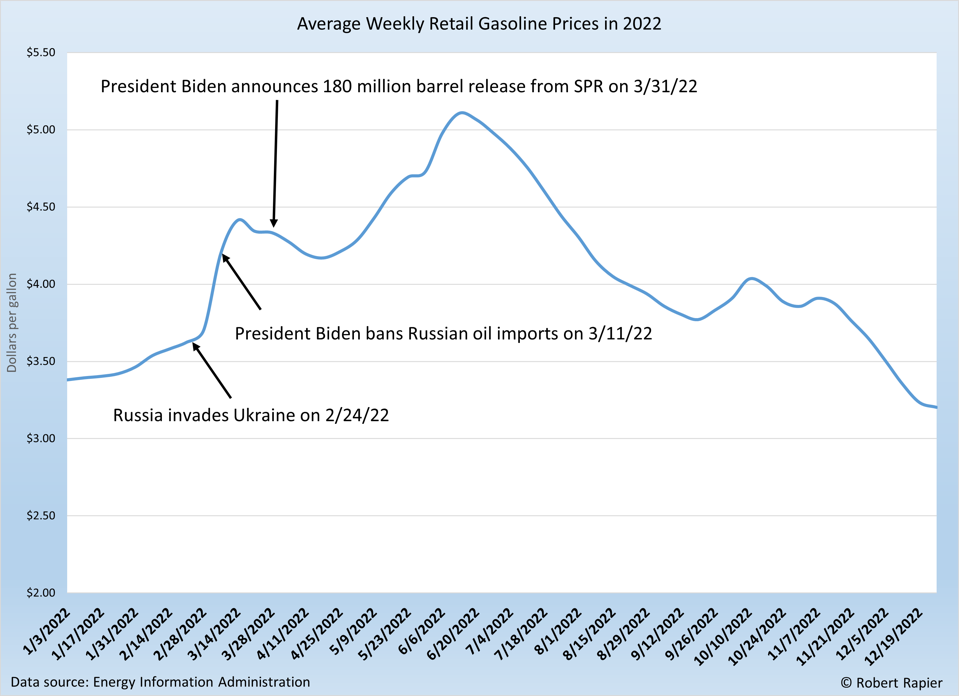

As I pointed out to some in response, I didn’t delve deeply into causation of high gas prices in that article. But let’s do that here. First, let’s look at the average weekly retail gasoline price in 2022 (source), with several significant events highlighted on the graphic.

We can see that gasoline prices began a steep climb within a week of Russia’s invasion. In the midst of that initial climb, President Biden signed an Executive Order (E.O.) to ban the import of Russian oil, liquefied natural gas, and coal to the United States.

One can certainly debate whether this ban was the right move (and I warned about the implications beforehand in Russia Is A Major Supplier Of Oil To The U.S.), but there is no question that this decision had an impact on oil and gas prices.

Of course, correlation does not imply causation, so let’s talk about what actually happened to impact gasoline prices.

The Russian oil we imported was largely finished products and partially finished products that were largely used to produce diesel in U.S. refineries. There are two high-demand seasons for diesel each year — spring planting season for farmers and fall harvesting season.

So, we had a refinery disruption that impacted diesel production justjust before a high demand period. In addition, this came at a period of extremely high jet fuel (like diesel, jet fuel is a “distillate”) demand, as people started to travel in large numbers after being pent up for some long as a result of the pandemic.

That caused an even greater spike last year in distillate prices, and it forced refiners to respond. However, when refiners shift production toward distillates, it comes at the expense of some gasoline production. This negatively impacted gasoline production just as refiners start building up stocks heading into high-demand gasoline season (summer).

Note that this isn’t just idle speculation. I had several discussions about these events with one of my former refinery managers, who explained exactly what the refiners were facing.

The other major event on the graphic is President Biden’s decision to release an unprecedented amount of oil from the U.S. Strategic Petroleum Reserve (SPR) as a tool to combat rising prices. This was a move I opposed, because I don’t view high prices as the kind of emergency the SPR is supposed to protect against. That would be more of a significant loss of oil imports that threatens to cause shortages. This wasn’t the situation last year, so I thought the SPR release was unwarranted.

But, as one of my critics argued “The only reason prices went down last year was that President Biden used the SPR politically in an election year.” Indeed, that probably helped reverse the price rise last year. At the same time, the withdrawals put the U.S. in a more vulnerable position with respect to our emergency oil reserves. Further, it’s easy to be cynical about this move, because politicians — of both parties — have often treated the SPR as the “Strategic Political Reserve”, to be used to placate voters upset with rising prices.

All of this led to the historic price increases in 2022. There isn’t one single cause, which is why some will say “It was Biden’s policies” and some will say “It was Russia’s invasion of Ukraine.” Both are true, but neither is the exclusive cause. Russia invaded Ukraine, and in response President Biden made an executive order that caused disruptions in the refining sector — even if many agree it was the right thing to do.

Follow Robert Rapier on Twitter, LinkedIn, or Facebook